Another year of top line growth and margin improvement

Net sales at €1076.7 M, +11.1%

+4.2% at constant exchange rates

+7.7% organic2 sales growth Adj. 3 EBITDA at around €101 M, +24%

margin of 9.4%

The Board of Directors of Safilo Group S.p.A. has today reviewed the Group’s preliminary1 key performance indicators for the financial year ended December 31, 2022. The full year annual results will be approved by the Board of Directors on March 9, 2023, during which the Group will also approve its medium-term economic and financial targets, which the management will present to the market on the following day during a Capital Market Day to be held in Milan.

With regards to the ongoing strategic analyses and taking into consideration the evolution of the product portfolio, the economic context, the competitive dynamics and a persistent production overcapacity, the Board of Directors, in reiterating the importance of the Santa Maria di Sala and Bergamo production sites, of the Padua logistic center, and the company’s creative capabilities, has given the management a mandate to explore alternative solutions for the Longarone plant the content of which will be better outlined in the coming weeks.

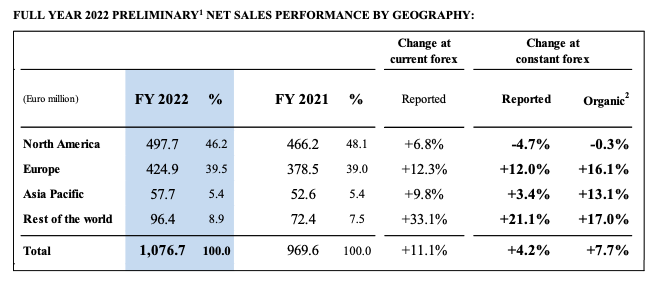

In 2022, Safilo’s preliminary1 net sales amounted to Euro 1076.7 million, up 11.1% at current exchange rates and 4.2% at constant exchange rates compared to Euro 969.6 million recorded in 2021.

In the year, organic2 sales grew by +7.7% at constant exchange rates, recording another significant improvement after the +10.5% achieved in 2021 compared to 2019. Own brands represented an important driving force behind the Group’s overall performance, in particular Smith, which with another strong increase in sales confirmed its position as one of the leading brands in the rapidly growing segment and distribution channel of outdoor eyewear and sports products. Carrera and Polaroid also posted yet another year of double-digit growth, broad based by distribution channel and product category, with Carrera far exceeding pre-pandemic levels.

Safilo’s licensed business also delivered very solid growth in the year, thanks to the positive development achieved by the eyewear collections of its leading licensed brands, and to the inclusion of new licenses in the portfolio which effectively contributed to offset the sales recorded in 2021 with the discontinued business.

By geographical area, Europe remained in 2022 the key growth driver, with the main markets of the area and the surging business in Turkey and Poland, contributing to the upside in revenues of 12.3% at current exchange rates, +12.0% at constant exchange rates and +16.1% at the organic2 sales level.

During the year, the North American market benefited from the strengthening of the dollar against the euro, closing up 6.8% at current exchange rates. The performance at constant exchange rates, in total down by 4.7%, was instead flattish versus 2021 at the organic2 sales level (-0.3%), reflecting a challenging basis of comparison, especially in the second half of the year.

Safilo reported very positive sales trends also in the Rest of the World, composed of the business in the IMEA and Latin American countries, as well as in Asia and Pacific, with the two areas respectively up 33.1% and 9.8% at current exchange rates, +21.1% and +3.4% at constant exchange rates, and +17.0% and +13.1% at the organic2 sales level.

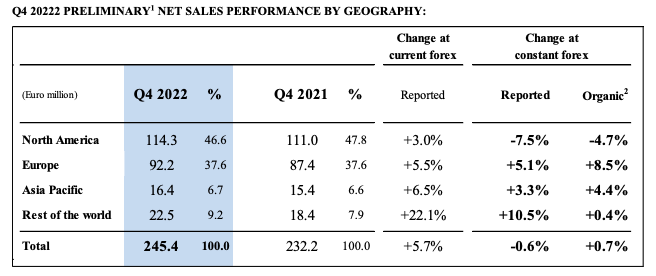

In Q4 2022, Safilo’s preliminary1 net sales amounted to Euro 245.4 million, up 5.7% at current exchange rates and substantially in line with the business recorded in Q4 2021 at constant exchange rates (-0.6% reported and +0.7% at the organic2 sales level). The quarter confirmed the strength of the Group’s business in Europe, which grew by 5.5% at current exchange rates, +5.1% at constant exchange rates and by a resilient +8.5% at the organic2 sales level notwithstanding the significant and expected contraction of the revenues generated through the GrandVision chain. In North America, total sales were up 3.0% at current exchange rates and down 7.5% at constant exchange rates. At the organic2 level, the business softened by 4.7% mainly due to the tough comps base with the +19.7% recorded in Q4 2021 vs ’19, and a softer US wholesale demand in the entry and mid-tier price points, while the premium and upper-end segments continued to hold up well. On the other hand, Smith posted a double-digit growth in the quarter, recovering the large part of the logistics delays impacting deliveries in the US sport shops channel in Q3, and also Blenders turned back to growth posting a positive quarter, with its online business back to a double-digit upside.

Q4 sales trends remained then supportive in Asia and Pacific, up 6.5% at current exchange rates, +3.3% at constant exchange rates and +4.4% at the organic2 level, as well as in the Rest of the World thanks to a solid business development in IMEA, and the new brands in the portfolio well supporting growth in the key Latin American markets (+22.1% at current exchange rates, +10.5% at constant exchange rates and +0.4% at the organic2 level).

On a preliminary1 basis, Safilo closed the full year 2022 with an adjusted3 EBITDA of around Euro 101 million, and a margin on sales of approximately 9.4% (10.3% ex IFRIC SaaS impact). Whilst slightly below management’s expectations, 2022 adjusted3 EBITDA corresponds to an increase of around 24% compared to Euro 81.5 million recorded in 2021, and to a margin improvement of 100 basis points compared to the 8.4% margin posted the year before.

On a preliminary basis1 , the Group’s net debt as at 31 December 2022 stood at around Euro 113 million (around Euro 70 million pre-IFRS 16, corresponding to a financial leverage, also pre IFRIC SaaS, of 0.7x), slightly better than the position of Euro 115,4 million reported at the end of September 2022 (Euro 67,2 million pre-IFRS 16, corresponding to a financial leverage, also pre IFRIC SaaS, of 0.7x) and slightly above Euro 94 million recorded at the end of 2021 (Euro 52,8 million pre-IFRS 16, corresponding to a financial leverage, also pre IFRIC SaaS, of 0.7x).

Notes to the press release:

1 Preliminary net sales, adjusted EBITDA and Group net debt for 2022 are unaudited.

2 Organic sales performance is provided at constant exchange rates and is calculated on the proprietary brands and not terminated licenses, present in both of the compared periods, excluding the business attributable to the production supply contract with Kering Eyewear.

3 The adjusted EBITDA excludes non-recurring items.

Statement by the manager responsible for the preparation of the company’s financial documents

The manager responsible for the preparation of the company’s financial documents, Mr. Gerd Graehsler, hereby declares, in accordance with paragraph 2 article 154 bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the accounting results, registers and records.

Disclaimer

This document contains forward-looking statements, relating to future events and operating, economic and financial results for Safilo Group. Such forecasts, due to their nature, imply a component of risk and uncertainty due to the fact that they depend on the occurrence of certain future events and developments. The actual results may therefore vary even significantly to those announced in relation to a multitude of factors.

Alternative Performance Indicators

The definitions of the “Alternative Performance Indicators”, not foreseen by the IFRS-EU accounting principles and used in this press release to allow for an improved evaluation of the trend of economic-financial management of the Group, are provided below:

• EBITDA (gross operating profit) is calculated by Safilo by adding to the Operating profit, depreciation and amortization;

• The Net Debt is for Safilo the sum of bank borrowings and short, medium and long-term loans, net of cash on hand and at bank. Such indicator does not include the valuation at the reporting date of derivative financial instruments and the liability for options on non-controlling interests.

About Safilo Group

Established in 1934 in Italy’s Veneto region, Safilo Group is one of the eyewear industry’s key players in the design, manufacturing and distribution of prescription frames, sunglasses, outdoor eyewear, goggles and helmets. The Group designs and manufactures its collections by blending stylistic, technical and industrial innovation with quality and skillful craftsmanship. With an extensive global presence, Safilo’s business model enables it to monitor its entire production and distribution chain. From research and development in five prestigious design studios, located in Padua, Milan, New York, Hong Kong and Portland, to its company-owned production facilities and network of qualified manufacturing partners, Safilo Group ensures that every product offers the perfect fit and meets the highest quality standards. Reaching approximately 100,000 selected points of sale worldwide with an extensive wholly owned network of subsidiaries in 40 countries and more than 50 partners in 70 countries, Safilo’s well-established traditional wholesale distribution model, which encompasses eyecare retailers, chains, department stores, specialized retailers, boutiques, duty free shops and sporting goods stores, is complemented by Direct-to-Consumer and Internet pure player sales platforms, in line with the Group’s development strategies.

Safilo Group’s portfolio encompasses own core brands: Carrera, Polaroid, Smith, Blenders, Privé Revaux and Seventh Street. Licensed brands include: Banana Republic, BOSS, Carolina Herrera, Chiara Ferragni, Dsquared2, Eyewear by David Beckham, Fossil, havaianas, HUGO, Isabel Marant, Jimmy Choo, Juicy Couture, kate spade new york, Levi’s, Liz Claiborne, Love Moschino, Marc Jacobs, Missoni, M Missoni, Moschino, Pierre Cardin, PORTS, rag&bone, Tommy Hilfiger, Tommy Jeans and Under Armour.

The parent company, Safilo Group S.p.A., is listed on the Euronext Milan organized and managed by Borsa Italiana (ISIN code IT0004604762, Bloomberg SFL.IM, Reuters SFLG.MI). In 2021, Safilo Group recorded net revenues for Euro 969.6 million